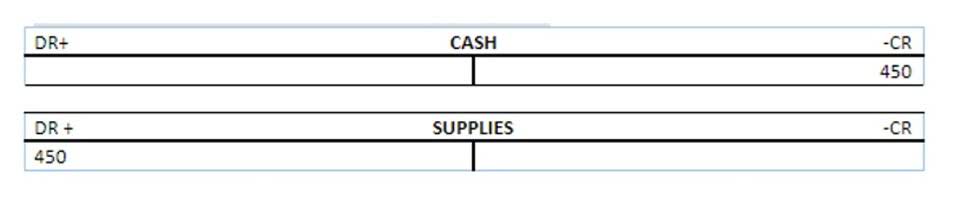

Bookkeeping

Quick Ratio: Definition, Formula, Uses

An increase in quick ratio can be due to various reasons, including an increase in cash and cash equivalents, a reduction in current liabilities, or a decrease in inventory levels. For example, if a company sells off its inventory or improves its inventory management practices, it can increase its quick ratio by reducing the inventory component in the calculation. The quick ratio can vary significantly across industries, so comparing a company’s quick ratio to industry norms is essential when evaluating its financial health.

A low Current Ratio, on the other hand, could indicate that a company is struggling to meet its short-term obligations. First, we need to identify the company’s current assets, which include cash, cash equivalents, accounts receivable, and any other assets that can be easily converted into cash. We then subtract the value of inventory and prepaid expenses from current assets. This is because inventory and prepaid expenses are less liquid than other assets and may take longer to convert into cash. It represents the proportion of current assets available to cover current liabilities. A liquidity ratio measures a company’s ability to meet its short-term obligations with its most liquid assets.

How to Interpret Quick Ratio

Similarly, investors want a reasonable assurance they will receive dividends from their investment. However, to maintain precision in the calculation, one should consider only the amount to be actually received in 90 days or less under normal terms. Early quick ratio is another commonly used term for the liquidation or premature withdrawal of assets like interest-bearing securities may lead to penalties or discounted book value. Cash equivalents are often an extension of cash as this account often houses investments with very low risk and high liquidity.

- It does not take into account factors such as long-term debt and depreciation which can also affect a company’s liquidity position.

- The quick ratio demonstrates the immediate amount of money a company has to pay its current bills.

- Analysts can determine whether a company is in a solid financial position or facing financial challenges by looking at a company’s quick ratio.

- Since these items take longer than one year to be converted into cash, they should not be considered part of a company’s ability to pay off its current liabilities.

- In this guide, we will explore everything you need to know about quick ratio, from its definition to how to calculate it and what a good ratio looks like for different industries.

- To use the real-world example, the chart of Tesla (TSLA) data above gives a sense of the normal disparity between quick and current ratios.

By calculating and interpreting quick ratios, investors and analysts can make informed decisions about a company’s financial stability and risk level. It is crucial to remember that the quick ratio is not a perfect metric and has limitations, but it remains a valuable tool for assessing a company’s liquidity. When the quick ratio increases, a company has more liquid assets to cover its short-term obligations. This is a positive sign as it indicates that the company has improved its liquidity position and is better equipped to meet its immediate financial obligations. A low quick ratio indicates that a company has a low level of liquid assets relative to its short-term liabilities.

Quick Ratio Explained: Definition, Formula, and Examples – Frequently Asked Questions

Each industry has a different set of working capital requirements, making this ratio challenging to reach. However, if you want to compare two companies in the same industry, this ratio can help determine which one has better liquidity. Accounting ratios also work as an important tool in company comparison within an industry, for both the company itself and investors. A company can see how it stacks up against its peers and investors can use accounting ratios to determine which company is the better option. Any higher than one means that a company has more than enough to pay off its short-term liabilities and also that it may not be very efficient in managing its liquid assets. Most often, companies may not face imminent capital constraints, or they may be able to raise investment funds to meet certain requirements without having to tap operational funds.

Suppose a company has the following balance sheet financial data in Year 1, which we’ll use as our assumptions for our model. For example, a company with a low ratio might not be at too much of a risk if it has non-core fixed assets on standby that could be sold relatively quickly. The quick ratio may also be more appropriate for industries where inventory faces obsolescence. In fast-moving industries, a company’s warehouse of goods may quickly lose demand with consumers.

What is considered a healthy Quick Ratio? Copied Copy To Clipboard

It is not uncommon for current ratios to be double, triple, or even 5X the quick ratio, depending on how inventory-heavy the business is. One thing to keep in mind when comparing quick ratios, is that companies across different sectors will have different standards for their quick ratios. If a company increases its inventory levels without a corresponding increase in sales, its quick ratio may decrease as more cash is tied up in inventory. Selling non-essential assets can generate cash for a company and improve its quick ratio.

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets. When choosing a city for your accounting career, consider factors like cost of living, job market, industry focus, networking potential, and lifestyle preferences. Top US cities for accountants include Washington D.C., New York City, Denver, Los Angeles, Boston, Chicago, and Dallas-Fort Worth, offering diverse opportunities and vibrant lifestyles.